Brisbane will need to effectively extend its CBD to Milton and Fortitude Valley and create far more office space by 2032, according to projections from Colliers Queensland.

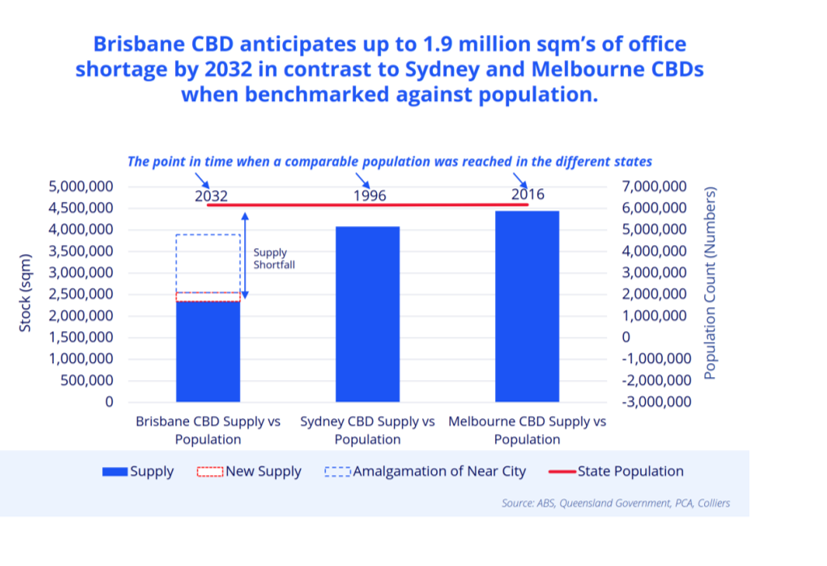

A new research report, released today, says an estimated 1.5 to 1.9 million square metres of new office space will be required over the next eight years.

This is the equivalent of 11 office buildings the size of the Queensland Government headquarters at 1 William St in the city.

Colliers Queensland Office Leasing National Director Matt Kearney said population growth and overseas migration would drive a redefinition of the Brisbane CBD in the leadup to the 2032 Olympic and Paralympic Games.

“To accommodate future population growth we can’t fit into the CBD alone, we will see the CBD amalgamate with near city areas making the CBD a much larger footprint,” he said.

“With 73 percent of the state’s population residing in SEQ, the significant correlation between population growth and the expanding CBD office sector in Brisbane is clear.

“There is a need for an expansion of office stock to accommodate the rising demand, particularly considering that, unlike other states with satellite cities, Brisbane sees a concentration of its workforce in the CBD.”

The report – Into the Golden Decade: Transformation of the Brisbane CBD – says, to accommodate the growth, would require office space to extend into areas like Fortitude Valley, Spring Hill, Bowen Hills and Milton.

Mr Kearney said there was only 205,700 square metres of office stock in the pipeline and 70 percent of this was already pre-committed.

He said, given costs of construction and labour shortages, the current pipeline would fall short of demand.

Colliers Queensland Capital Markets Associate Director Sam Arkell said Brisbane was experiencing an “increase in the weight of capital viewing” as an investment destination.

“This is being fuelled by favourable occupier fundamentals that continue to outperform other major Australian markets,” he said.

“Over the last decade, the Brisbane CBD office market has experienced significant capital injections exceeding $16 billion with an additional $10 billion invested in the city fringe.

“The Brisbane CBD office market’s appeal lies in its attractive yields, strong occupier markets with the strongest rental growth seen since the 2000’s and Brisbane’s relative value compared to other eastern seaboard markets, making it an enticing prospect for ongoing investment.”