By Adrian Lee

For many, the “Great Australian Dream” of owning a home has never felt further out of reach. Rising property values have convincingly outpaced income growth over recent decades, creating an affordability crisis.

That doesn’t necessarily mean all Australians have given up on dreaming. A recent survey by Mortgage Choice suggests even among members of Gen Z (born from roughly 1996 to 2012), many remain staunch in their desire to buy their own home.

Saving the deposit required for a loan – typically 10 percent to 20 percent of a property’s purchase price – has always been one of the biggest hurdles to home ownership.

From today, October 1, eligibility for the Australian government’s Home Guarantee Scheme is expanding. All first-home buyers who’ve saved a 5% deposit will be able to apply. So what’s changing – and how might this initiative help first-home buyers? What could be the risks and drawbacks?

Straining to save enough

Saving a deposit is a crucial step for most first-home buyers. This is the amount in cash you pay upfront for the home; the bank lends you the rest.

Generally speaking, the higher your deposit, the safer the bank feels in lending to you.

Typically, a borrower would need to have saved up 20 percent of the home’s price, or else have to pay lenders mortgage insurance, which protects the lender if the loan defaults. Given the average value of an Australian home is now about $1,000,000, this would mean having $200,000 saved up in cash.

That’s well above where most young people find themselves. According to a report by Finder, the average Australian had $39,407 in savings in 2024, but among Gen Z this figure was lower, at $17,260.

Unfortunately, there is no magic formula to saving. The definition is money earned that then isn’t spent. High interest savings accounts and term deposits are among the options for growing savings with the lowest risk.

Investing savings in assets such as shares may grow a deposit faster, but carries greater risk and could result in losing money.

Still, even for those earning a relatively high income who save aggressively and manage to invest wisely, it can take years to reach a 20 percent deposit.

Getting to the starting line – faster

This is where the Federal Government’s newly expanded 5 percent deposit scheme may be able to step in and assist some first-home buyers.

This initiative first launched in 2020. But over the years it’s been subject to income caps, as well as limits on the number of places available. From today, October 1, these have been removed, so all Australian first-home buyers can apply for the scheme through a participating lender.

Caps on maximum property prices remain, but have now been increased across many cities and regions.

For successful applicants, the Home Guarantee Scheme allows first-home buyers to apply for a loan having saved just 5 percent of the home’s price as a deposit instead of the usual 20 percent, without having to pay lenders mortgage insurance.

That’s possible because the government will guarantee a portion of the loan to provide surety to the bank.

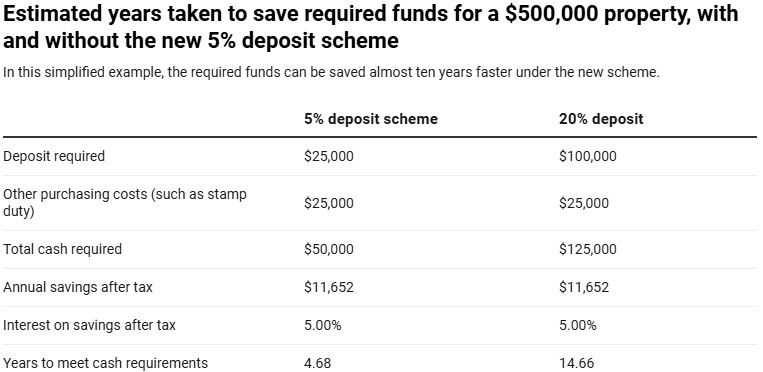

Here’s an example to illustrate how much time the new scheme could save.

Note, this makes some simplifying assumptions about tax and transaction costs. Real-life home loans are more complex.

Imagine a Gen Z first-home buyer eyeing off a property with a modest price of $500,000. A 20 percent deposit on this property would be $100,000 – but a 5 percent deposit just $25,000.

The additional costs of buying a home – such as stamp duty – also need to be saved. Let’s imagine these add up to $25,000.

According to the Finder report mentioned earlier, the average Gen Z is saving $971 a month. If we keep things simple and assume that’s after tax, that works out to be $11,652 a year.

And finally, let’s assume these savings can be invested at an interest rate that for this individual, works out to be 5 percent after tax. Using all these assumptions, the table below shows how much faster a deposit could be saved under the new scheme.

One important drawback

In this illustration, the scheme knocks about 10 years off the time required for our buyer to save the funds required. So, what’s the catch?

One important drawback needs explaining. All else being equal, paying a lower deposit means taking out a bigger loan. This means regular repayments to the bank are also much higher.

Returning to our above example, the total loan size would be $475,000 with the 5 percent deposit scheme, versus just $400,000 with a 20 percent deposit.

Using a repayment calculator for a 30-year loan at 5.42 percent interest, monthly repayments would be $422 higher with a 5 percent deposit (total repayment of $2673 versus $2251).

Things to consider

So, while our first-home buyer may be able to buy a home sooner, they could also be in for more long-term pain. Also, due to the higher loan amount, the bank will want to make sure you can service the loan.

This means checking you have enough income (typically salaries or wages) to afford the higher repayments and avoid “mortgage stress”. A common definition of mortgage stress is when 30 percent or more of a household’s income is going towards mortgage repayments and related housing costs.

– Adrian Lee is an Associate Professor in Property and Real Estate, Deakin University.

This article first appeared in The Conversation.