Millennials are the most active property investors, according to the latest CommBank data.

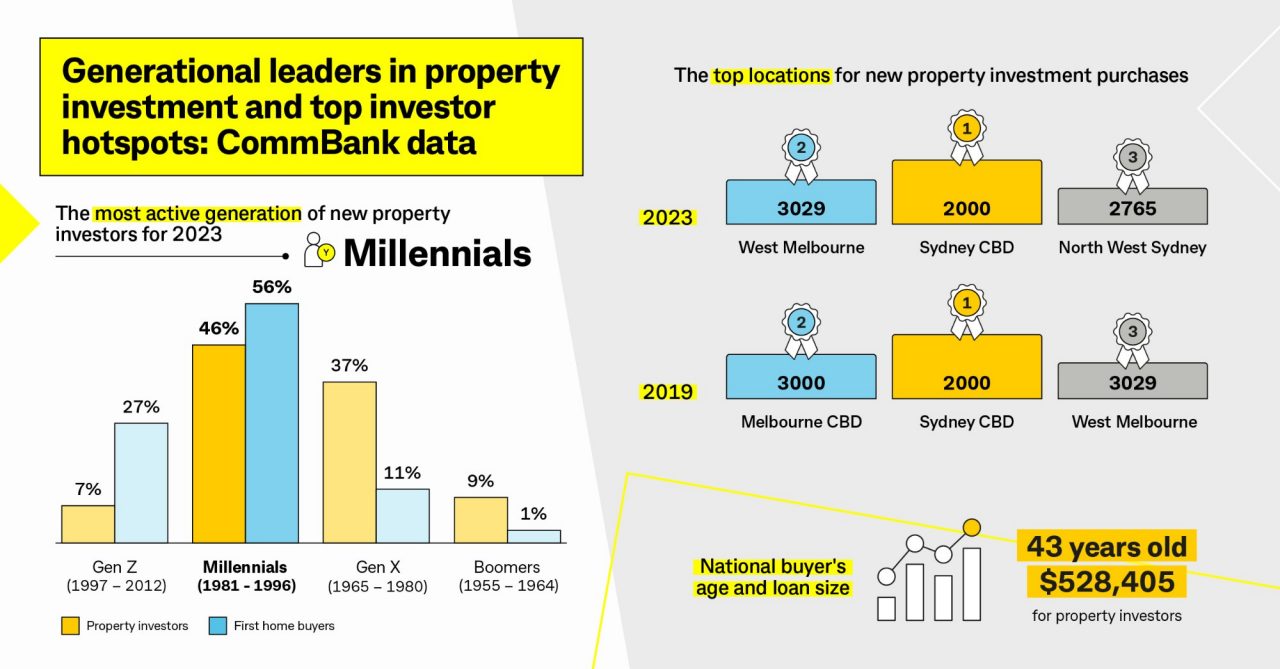

Last year 46 percent of the bank’s new property investors were born between 1981 and 1996. They were followed by Gen X (born 1965-1980), who accounted for 37 percent.

Millennials were also the biggest first home buyers accounting for 56 percent of approvals in 2023.

The data showed that the average age of a property investor was 43 years, and the average loan size was just over $500,000.

Commonwealth Bank Executive General Manager Home Buying Dr Michael Baumann said a significant proportion of millennial property investors opted to purchase property alone.

“From our data, we can see that almost one third of all millennial property investors actually purchased their investment property on their own,” Dr Baumann.

Over the past year, data from the Australian Bureau of Statistics found investors were the key driver of new lending, with lending growth to this segment reaching 18.5 percent.

The bank data showed lending to first home buyers rose by 13.2 percent, while owner-occupiers saw a 3.4 percent increase in lending.

“Interestingly, what we continue to see from many Aussies is the inclination to ‘rentvest’, buying property where they can afford and then renting where they wish to live,” Dr Baumann said.

“Rentvesting gives Australians the chance to get their foot on the property ladder sooner rather than later and purchase a property in a lower cost area without having to give up the lifestyle they have become accustomed to when renting.”