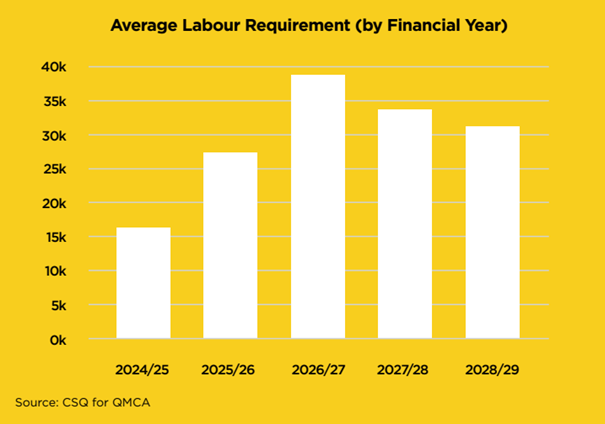

Another lift in the construction pipeline for Queensland will create demand for more than 20,000 extra jobs over the next two years.

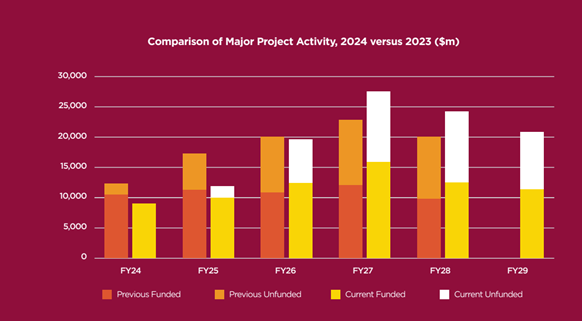

The Queensland Major Projects Pipeline 2024 report says major construction work in the state is now valued at $103.9 billion over the next five years.

This was a 13 percent, or $12 billion, increase from the 2023 projections.

This would lead to average labour demand increasing from 16,600 workers in the current financial year to 38,500 at the peak in 2026-27. Demand would then remain above 30,000 in 2027-28 and 2028-29.

“The 2024 QMPPR presents a generally positive outlook for major project work in Queensland, but also acknowledges the constraints and risks by sector and region,” the report says.

“While activity in 2024-25 was lower than predicted a year ago, relatively robust growth in major project work is predicted for 2025-26 and 2026-27 with transport-related activity joined by a strong phase of investment in water and energy-related projects.

“As in previous years, activity could surge higher if the large bank of currently unfunded projects were committed to.”

The report, released by the Queensland Major Contractors Association, says that 20 percent of the increased value of the major projects pipeline is due to cost increases on existing projects.

The pipeline has also been impacted by the Federal Government’s review of infrastructure funding in 2023.

This had caused a ripple effect of delays in projects progressing into procurement and delivery.

“This has had strong implications for the Queensland market, where the works delivered in 2024-25 were 11 percent less than predicted a year ago and the current financial year (2024-25) has an anticipated 13 percent reduction in the delivery of planned work,” the report says.

“Planned projects have also been shifted sideways to accommodate increased costs on existing projects.”

The report says the high levels of activity combined with competition for skills and resources from other states will put sustained pressure on costs, industry capability (skills) and capacity.

“We are also facing a far more complex environment regarding project development, approvals and financial decisions, in addition to a very tight labour market,” the report says.

“Changes made to taxation, environmental approvals and in particular the industrial relations environment, have had – and continue to have – a negative impact on project viability and investment confidence.

“It is important that these industry level concerns are addressed to ensure that investment decisions can be made in a timely manner with a proper understanding of the expectations on the project developers and the construction industry.”

While the overall major project outlook for Queensland has improved, Cairns, Brisbane, Gold Coast, Townsville, Darling Downs–Maranoa and Outback have lower levels of funded works than last year.

“Activity outside of South-East Queensland remains the most uncertain,” the report says.

“Much of the unfunded work in this year’s pipeline continues to remain concentrated in regions outside of Brisbane, with Fitzroy and Mackay-Isaac together making up 55 percent of total unfunded work.”

The full report is on the QMCA website.