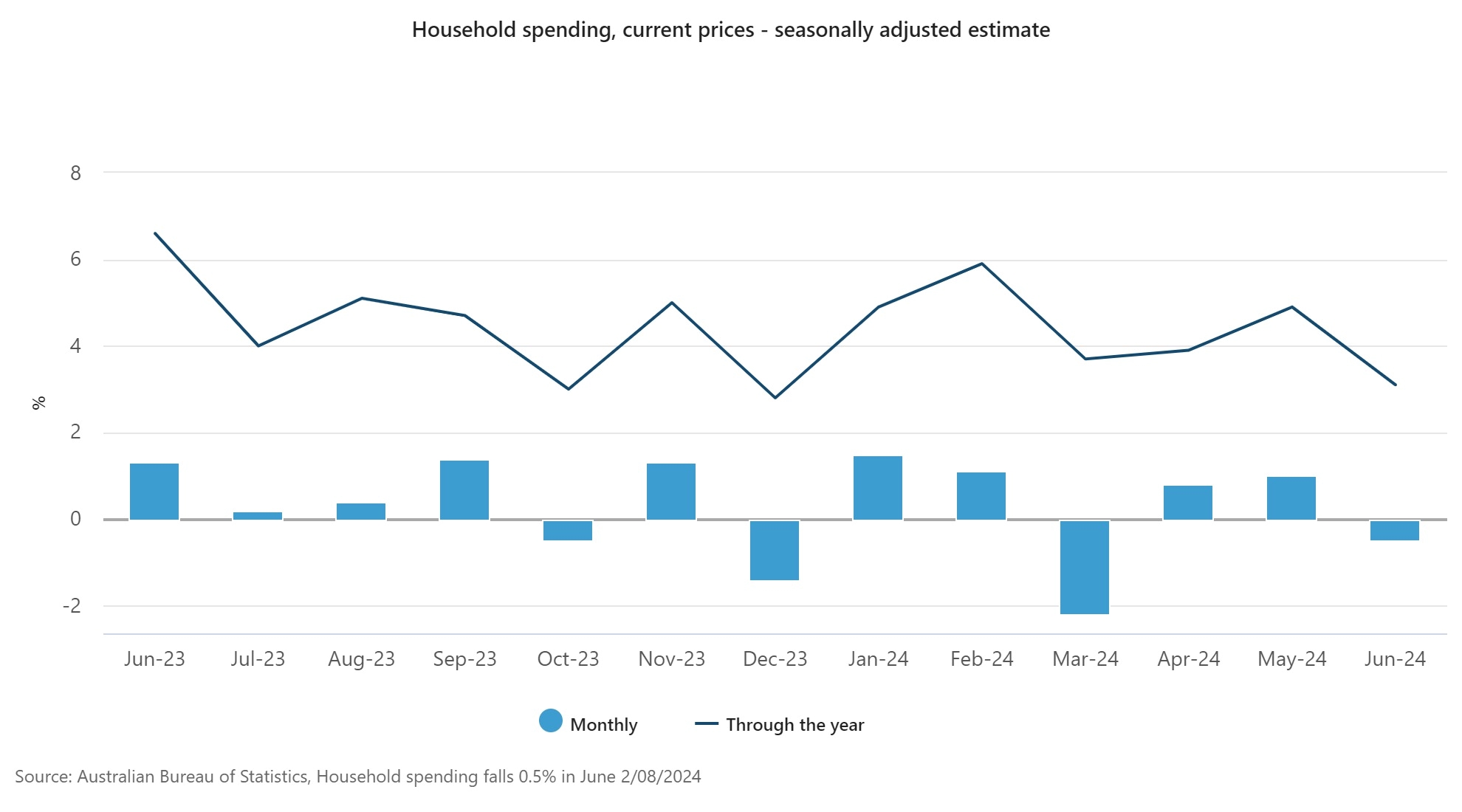

Australian consumers returned to tightening their belts in June, with spending falling for the first time since March.

Australian Bureau of Statistics (ABS) data released today showed household spending fell 0.5 percent last month, after consecutive rises of 1.0 percent in May and 0.8 percent in April.

ABS head of business statistics Robert Ewing said this was the first month where the spending indicator included seasonally adjusted data for selected categories.

“This new data shows households spent less on Services in June, but more on Goods compared to May,” Mr Ewing said.

He said lower spending on recreational and cultural services, hotel accommodation, and dining out contributed to the 1.8 percent drop in Services spending.

“The fall was partially offset by a 0.5 percent rise for spending on Goods, as households took advantage of end-of-financial-year sales.”

Mr Ewing said household spending rose in all states and territories compared to the same time last year in calendar adjusted terms.

He said the largest percentage rises in spending were seen in Western Australia (+6.8 percent), Queensland and the Australian Capital Territory (both +5.6 percent).

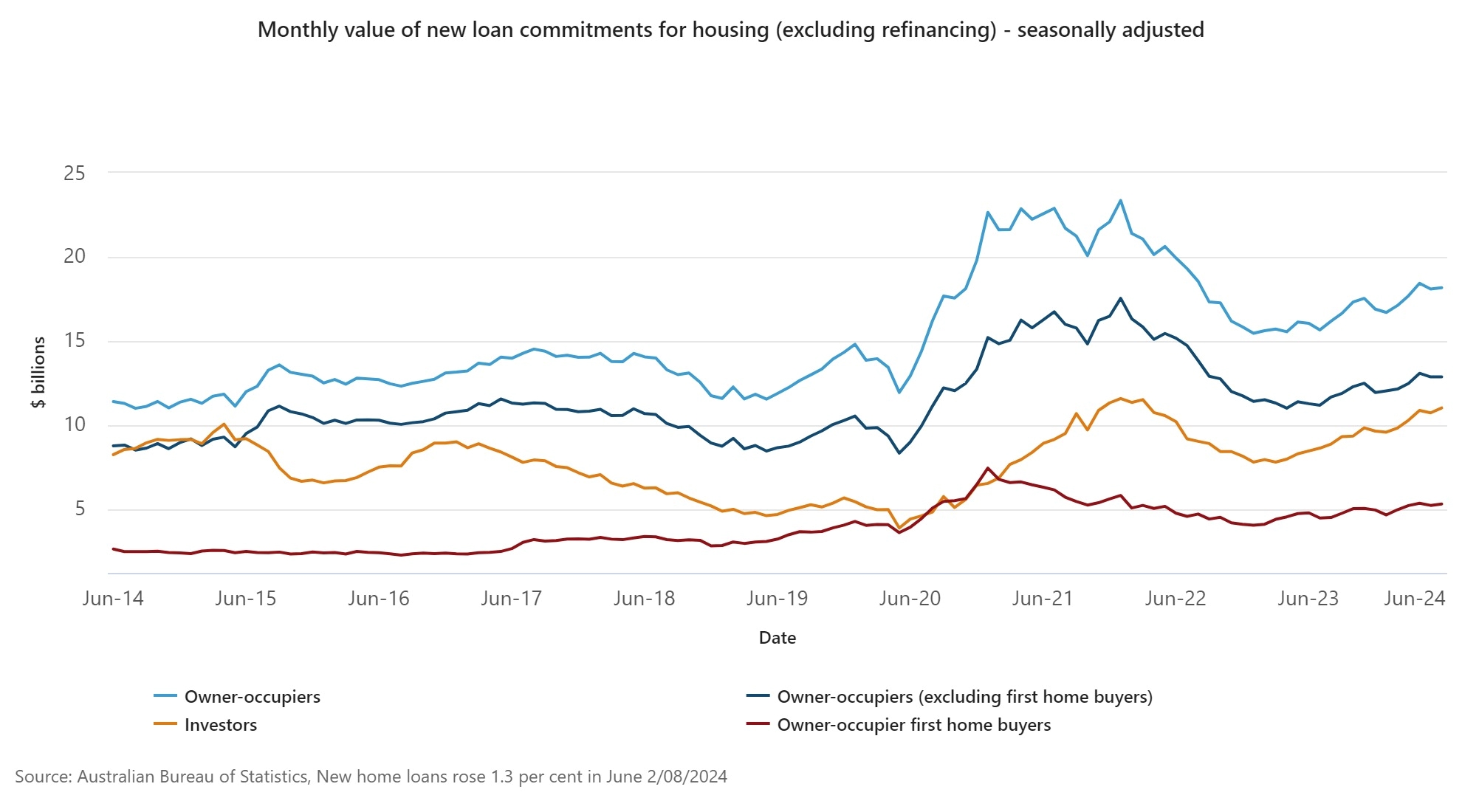

Meanwhile, the total value of new housing loans rose 1.3 percent in June to $29.2 billion.

ABS head of finance statistics Mish Tan said the value of new owner-occupier loans grew by 0.5 percent to $18.2 billion, while the value of new investor loans grew by 2.7 percent to $11.0 billion.

“Investor lending growth continued to outpace the growth of owner-occupiers in June. The total value of new investor loans was 30.2 percent higher compared to a year ago, while for owner-occupiers it was 13.2 per cent,” Dr Tan said.

While growth in the value of new investor loans was seen across all states and territories over the past 12 months, it was driven by New South Wales (up 27.3 percent or $901m), Queensland (up 34.5 percent or $587m) and Western Australia (up 56.7 percent or $428m).