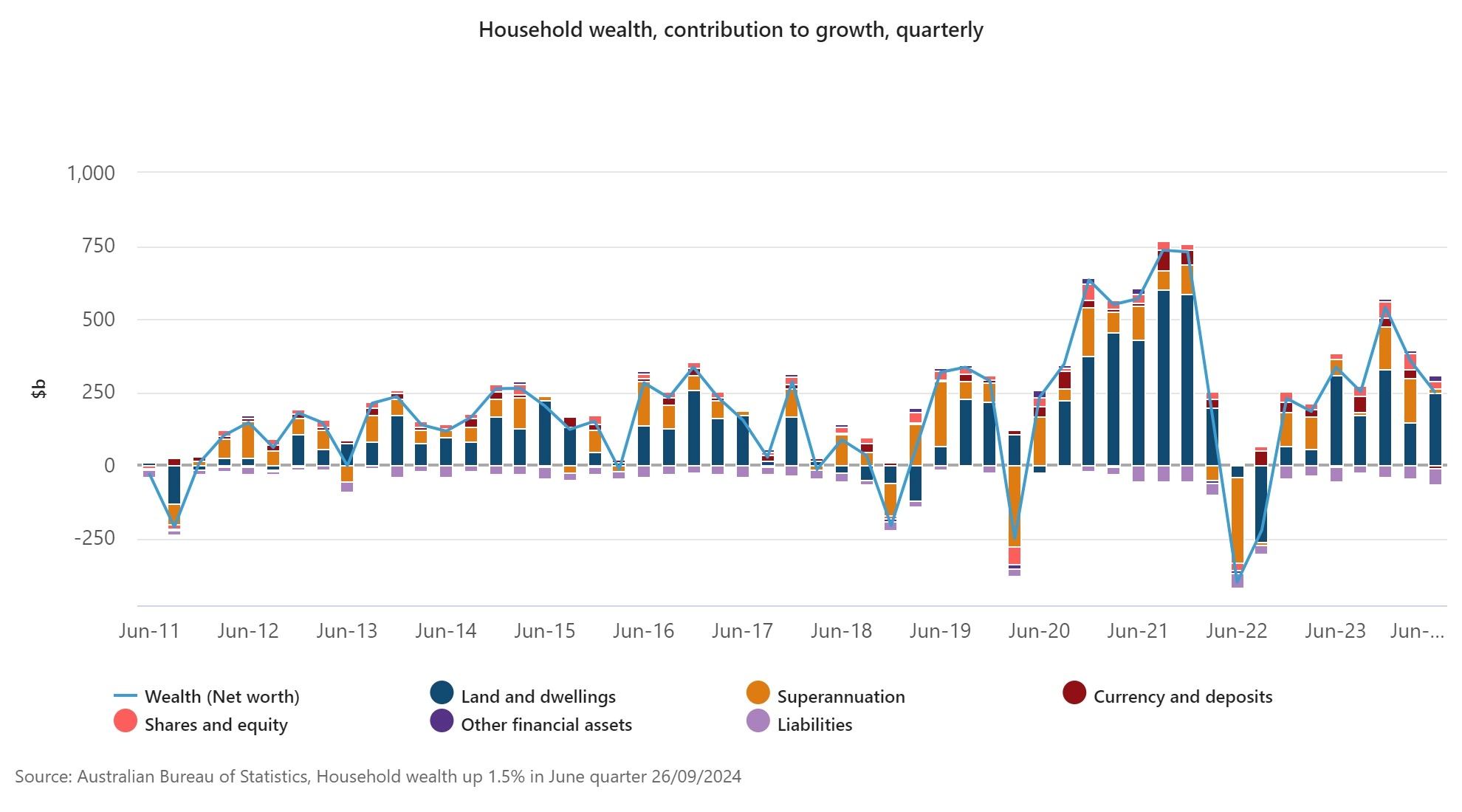

Australian household wealth continues to rise, with $250 billion added in the June quarter of this year.

Australian Bureau of Statistics (ABS) figures showed the 1.5 percent increase was the seventh consecutive quarterly rise.

ABS Head of Finance Statistics Mish Tan said total household wealth was $16.5 trillion in the June quarter, which was 9.3 percent, or $1.4 trillion, higher than a year ago.

Dr Tan said this was largely driven by residential land and dwellings, contributing 1.3 percent to quarterly growth.

“House prices have continued to rise across most states and territories, despite high interest rates. This largely reflects ongoing housing supply constraints and an uptick in investor activity over the quarter,” she said.

Dr Tan said the growth in household wealth was also supported by superannuation assets, which rose by 0.3 percent, or $13.7 billion, in the June quarter.

The quarter also saw the final allowance under the Term Funding Facility (TFF) from the COVID-19 pandemic mature.

“The TFF gave banks access to low-cost funding during the pandemic. With the final maturation of the TFF in June, banks have continued a return to more traditional sources of funding,” Dr Tan said.

She said this had impacted bank funding across financial markets.

“For example, banks exchange settlement accounts with the Reserve Bank of Australia fell $106.5 billion (-32.3 percent) as the $105.0 billion of securitised bonds used as collateral returned to bank balance sheets.”

Dr Tan said total demand for credit was $97.9 billion, driven by Households ($57.5 billion) and Private non-financial businesses ($36.9 billion).

“This figure was partly offset by a $2.2 billion drop in demand for credit by General government.”