The Reserve Bank of Australia (RBA) board has announced the expected 0.25 percentage points increase in the base interest rate, bringing the cash rate to 3.85 percent.

This was to address growing concerns about the level of inflation. It is the first upward movement in rates for two years.

The increase will put further cost-of-living pressures on home owners struggling with large mortgages.

The cash rate is set by the Reserve Bank of Australia for overnight loans between commercial banks. It acts as a benchmark for interest rates for mortgages, personal loans, and savings accounts

In a statement released after its meeting today, the RBA said that while inflation had fallen substantially since its peak in 2022, it picked up “materially” in the second half of 2025.

“The Board has been closely monitoring the economy and judges that some of the increase in inflation reflects greater capacity pressures,” the statement said.

“As a result, the Board considers that inflation is likely to remain above target for some time.”

The board said the capacity pressures reflected greater demand momentum in recent months.

Private demand had strengthened “substantially” more than expected, driven by both household spending and investment.

“Activity and prices in the housing market are also continuing to pick up.” the RBA said. “Financial conditions eased over 2025 and it is uncertain whether they remain restrictive.

“Credit is readily available to both households and businesses and the effects of earlier interest rate reductions are yet to flow through fully to aggregate demand, prices and wages.”

The full Reserve Bank statement can be found here.

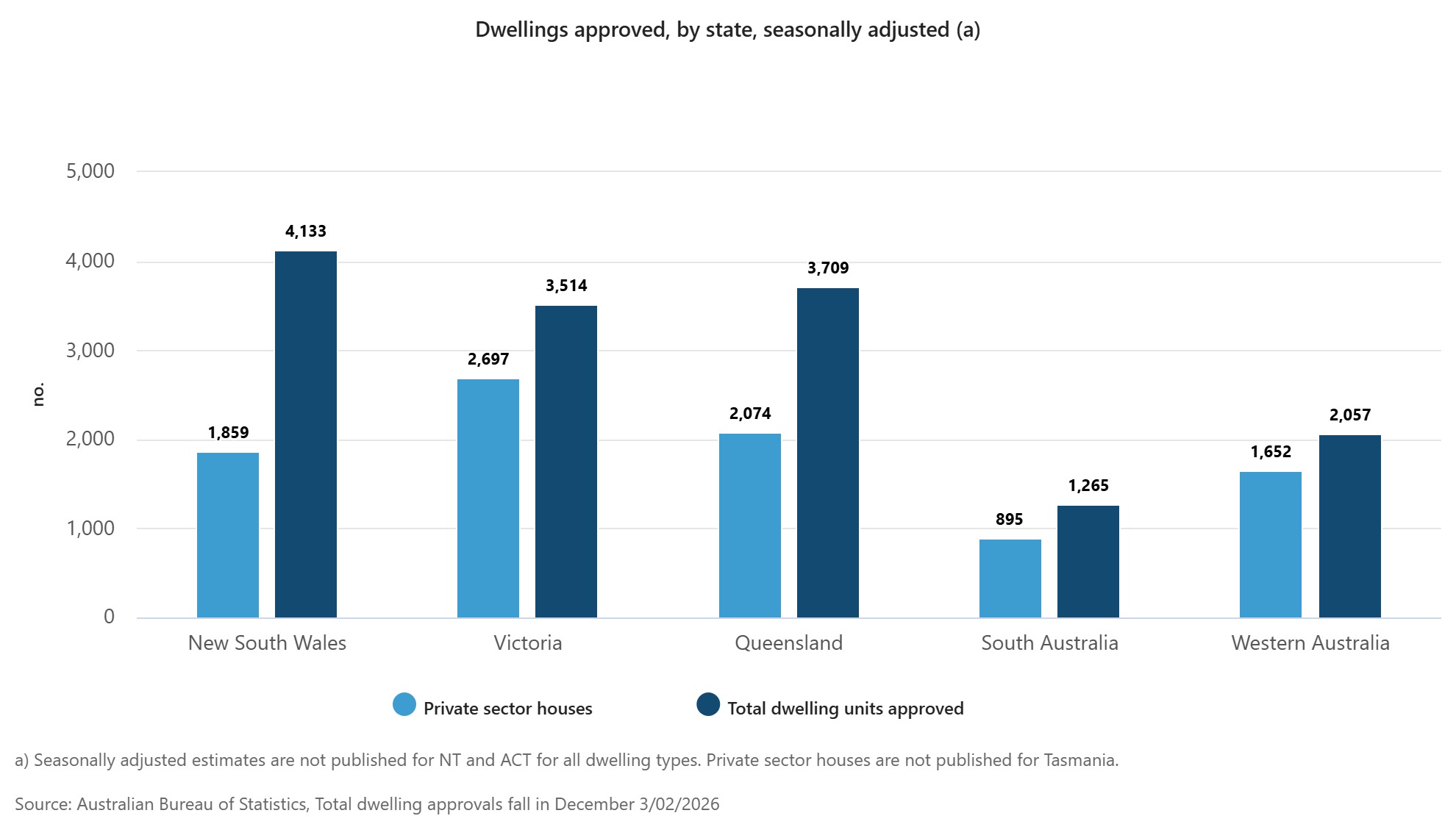

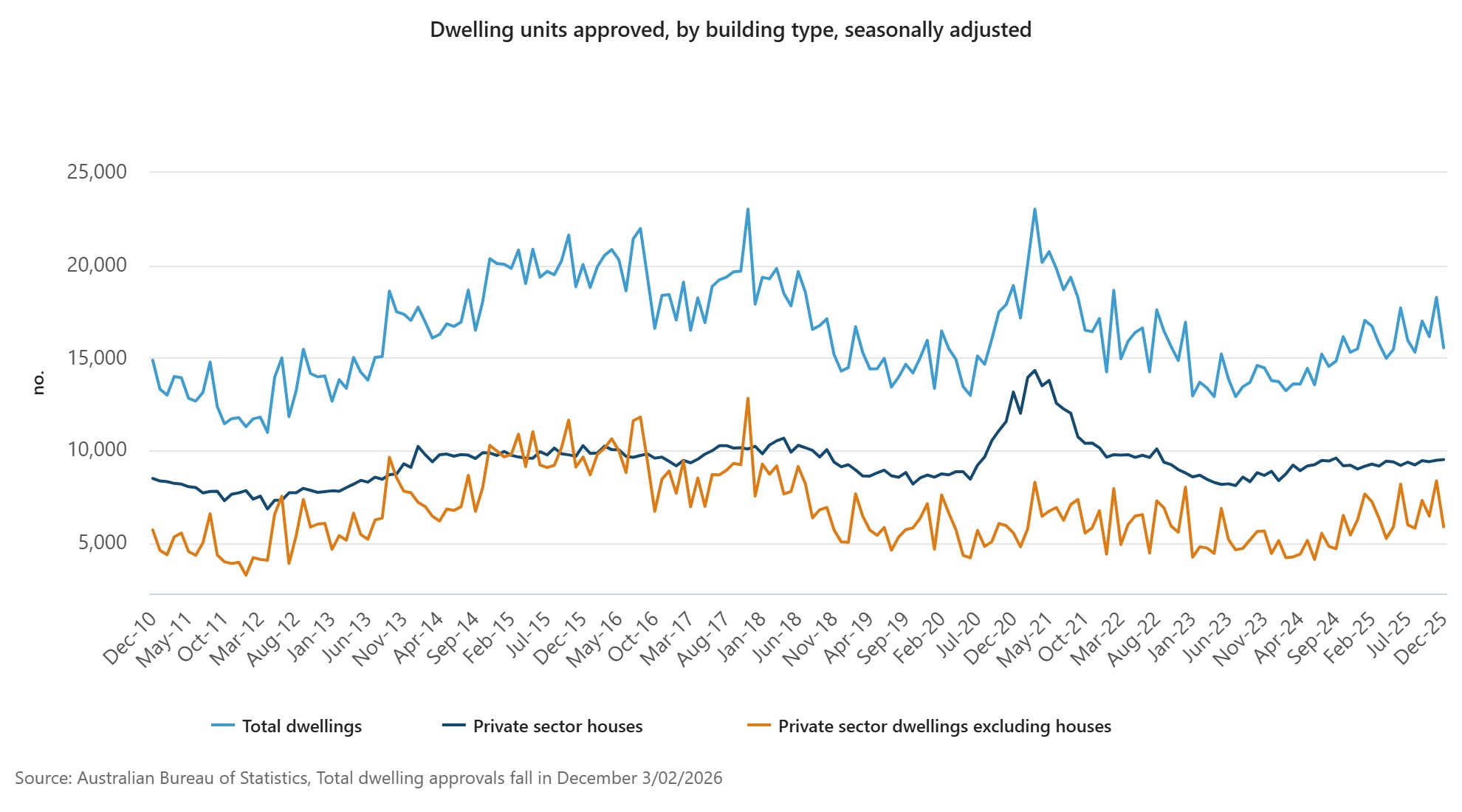

The RBA announcement came as the Australian Bureau of Statistics released figures showing a 14.9 percent fall in dwelling approvals nationally in December.

ABS head of construction statistics Daniel Rossi said the seasonally adjusted drop in total dwellings was driven by a 29.8 percent fall in approvals for private dwellings excluding houses.

This followed a 29.6 percent rise in this series in November. Private sector house approvals rose 0.4 percent.

‘While the fall in December (approvals) was large, it came off the back of last month which had the highest number of private sector dwellings excluding houses approved since June 2018,” Mr Rossi said.

The full report is on the ABS website