The global economy has turned the corner, with inflation easing and real incomes improving around the world.

The OECD‘s Interim Economic Outlook found global growth remained resilient through the first half of 2024, though significant risks remained.

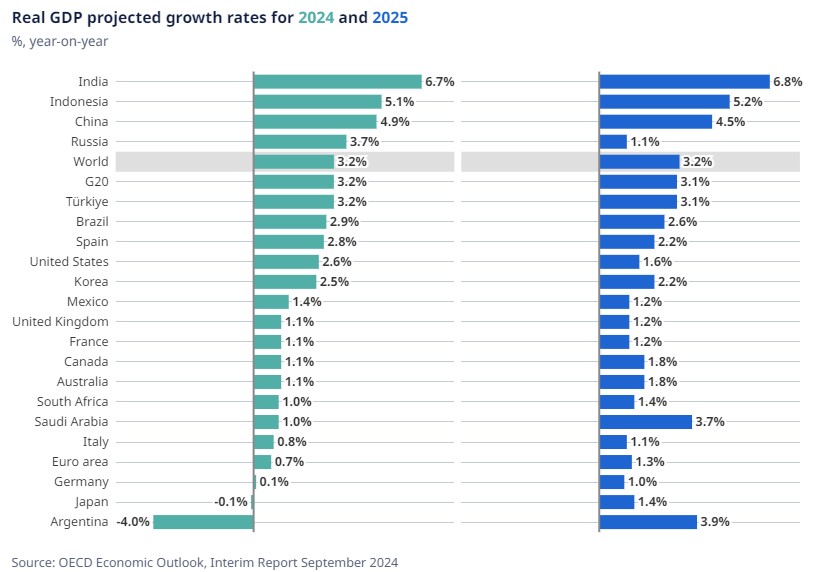

OECD Secretary-General Mathias Cormann said with robust growth in trade, improvements in real incomes and a more accommodative monetary policy in many economies, the Outlook projected global growth persevering at 3.2 percent in 2024 and 2025, after 3.1 percent in 2023.

Secretary-General Cormann said inflation was projected to be back to central bank targets in most G20 economies by the end of 2025.

“Headline inflation in the G20 economies is projected to ease to 5.4 percent in 2024 and 3.3 percent in 2025, down from 6.1 percent in 2023, with core inflation in the G20 advanced economies easing to 2.7 percent in 2024 and 2.1 percent in 2025,” he said.

Secretary-General Cormann said GDP growth in the United States was projected to slow from its recent rapid pace, but would be cushioned by monetary policy easing, with growth projected at 2.6 percent in 2024 and 1.6 percent in 2025.

He said in the euro area, growth was projected at 0.7 percent in 2024, before picking up to 1.3 percent in 2025, with activity supported by the recovery in real incomes and improvements in credit availability.

“China’s growth is expected to ease to 4.9 percent in 2024 and 4.5 percent in 2025, with policy stimulus offset by subdued consumer demand and the ongoing deep correction in the real estate sector.”

The OECD report shows Australian growth to be 1.1 percent this year, growing to 1.8 percent in 2025, while India leads the world with growth above 6.7 percent over the two years.

Secretary-General Cormann said declining inflation provided room for an easing of interest rates, though monetary policy should remain prudent until inflation had returned to central bank targets.

He said decisive policy action was needed to rebuild fiscal space by improving spending efficiency, reallocating spending to areas that better support opportunities and growth, and optimising tax revenues.

“To raise medium-term growth prospects, we need to reinvigorate the pace of structural reforms, including through pro-competition policies, for example by reducing regulatory barriers in services and network sectors.”

Secretary-General Cormann said the Outlook highlighted a range of risks.

He said the impact of tight monetary policy on demand could be larger than expected, and deviations from the expected smooth disinflation path could trigger disruptions in financial markets.

“Persisting geopolitical and trade tensions, including from Russia’s war of aggression against Ukraine and evolving conflicts in the Middle East, risk pushing up inflation again and weighing on global activity.

“On the upside, real wage growth could provide a stronger boost to consumer confidence and spending, and further weakness in global oil prices would hasten disinflation.”

He said as inflation moderates and labour market pressures eased further, monetary policy rate cuts should continue, even though the timing and the scope of reductions would need to be data-dependent and carefully judged to ensure inflationary pressures are contained.

“With public debt ratios elevated, rebuilding fiscal space is key to be able to react to future shocks and future spending pressures, including from population ageing and needed investments in the digital transformation and the climate transition.”