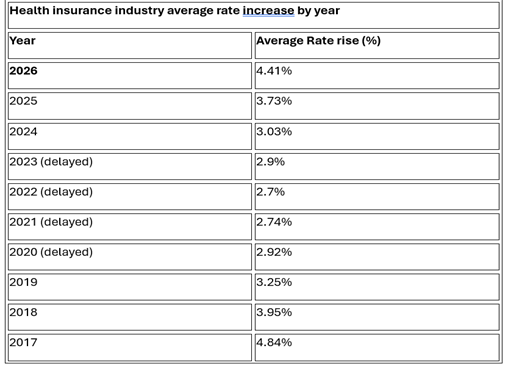

Health insurance premiums will rise by 4.41 percent in April, the largest annual increase in almost a decade.

Federal Health Minister Mark Butler said the decision was made based on submissions from the sector and insurers.

The Government approved an average premium increase of 4.41 percent to take effect from April 1, 2026.

“This is moderately higher than last year’s increase of 3.73 percent and reflects the rising costs of providing medical and hospital services, which rose five percent last financial year,” Mr Butler said in a statement.

“The Albanese Government will provide $7.9 billion this year to Australian policyholders through the private health insurance rebate after our Government reintroduced indexation of the rebate threshold in 2024.”

Mr Butler said the premium rise reflected increasing wage bills and the need to secure the viability of private hospitals.

Each insurer’s average price change will be published on health.gov.au.

Consumers were also encouraged to use the government website www.privatehealth.gov.au to compare the range of products and prices on offer from all insurers.

“The Government understands the pressure health insurance premium changes put on Australians and decisions about private health insurance premiums must put consumers first,” Mr Butler said.

“This year’s decision reinforces that premium increases must be backed by clear evidence and contribute to system-wide improvements, not just insurer balance sheets.”

In a statement, price comparison group Compare the Market pointed out that the average increase was above the inflation rate and reflected rising treatment costs and industry pressures.

Compare the Market’s Economic Director David Koch urged people to run price comparisons to ensure they were getting the best value from their policy.

“If your fund’s increase is above average, it may be time to shop around for better value” he said.

A Compare the Market survey found people who stayed with the same fund for over a decade spent 29 percent more on premiums, on average, compared to people who had joined their fund less than a year ago.

“If having cover is important to you, look for cheaper options,” Mr Koch said.

“Remember, you don’t need to re-sit any waiting periods you have already served if you’re changing to the same level of cover or below.”

Compare the Market released the table below showing annual increases over the past decade.